“Tech transfer”: For drug development professionals, no two words conjure up more fear of exploding timelines and ballooning budgets. As essential and universal as this process may be, it’s still one of the most notorious bottlenecks in the industry—a time- and resource-consuming hurdle that slows all too many launches to a crawl.

So what if I told you there was a way to reduce transfer times from months to weeks and dramatically lower the average costs of a transfer project, all while reducing risk and improving the likelihood of success? Well in this blog, I’ll show you exactly how that’s possible—and how some top drug developers are already unlocking those outcomes today.

First, let’s talk about the problem.

Historically, if you asked a drug development professional to name the biggest gating factor on their timelines, the answer would be quick and easy: Clinical studies. Those eternal recruitment and data analysis processes!

In the past, at least in theory, living in the shadows of clinical development gave CMC programs and manufacturing teams “plenty of time” to execute processes like tech transfers. Why rush? After all, everyone would inevitably be waiting for the clinical data to read out.

But now, no more.

In the last decade alone, clinical development programs have dramatically optimized and streamlined their operations—and in doing so, they’ve flipped the script on their cousins in technical development. Now, with clinical trials transformed and accelerated in many different ways, Clinical and CMC have largely traded places on the critical path to launch—leaving CMC programs scrambling to streamline suddenly glaring inefficiencies in processes like tech transfer.

COVID-19 put an especially harsh spotlight on that specific issue. Global-scale vaccine development demanded hyper-aggressive timelines with an unprecedented pace and volume of tech transfers, and the industry’s traditional document-based processes simply couldn’t keep up. While clinical evaluation of COVID vaccines advanced at a groundbreaking pace, manufacturing became the bottleneck—and tech transfers’ multitude of inefficiencies finally became impossible to ignore.

Since then, many industry stakeholders have come to the consensus that CMC needs to evolve to keep pace with clinical science—and yet, despite the all-too-well-understood issues in the tech transfer process, many organizations still approach it with the same antiquated, document-based methods. As more and more leaders are stepping forward to say, this needs to change. The industry needs a new approach to tech transfer that keeps this vital step from delaying the launch of more innovative new therapies.

So how big of a problem does that new approach need to fix? Let’s take a closer look.

Where does all that time and money go?

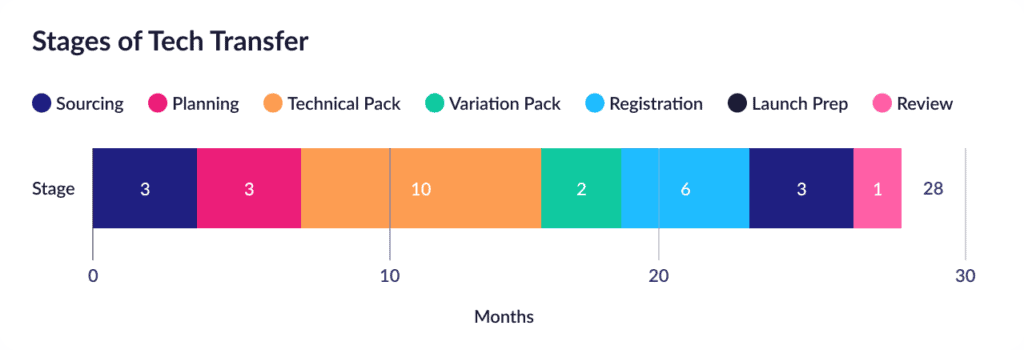

Here’s the bracing answer from a recent McKinsey report on the state of industry tech transfers. The average tech transfer currently ranges from 24 to 30 months, spread across a fairly predictable series of stages:

Layering on the ISPE’s good practice guides on knowledge management and technology transfer then adds some more useful detail around the planning and technical transfer stages, where the activities are broken down into the following stages:

- Form tech transfer team and develop charter

- Consolidate knowledge for transfer

- Agree to high level transfer proposal

- Identify risks, conduct risk assessments, and develop transfer plan

- Operational readiness

- Process (procedure) qualification

- Finalize tech transfer and perform review

Put these analyses together, and we can quickly see the trend: Pick a tech transfer project, and roughly half of it will likely be focused on planning and executing the transfer, including consolidating and organizing the critical product information and evaluating corresponding risks. Managed manually, using conventional documents, this hunt/gather/collate/analyze process is a common driver of extended tech transfer timelines.

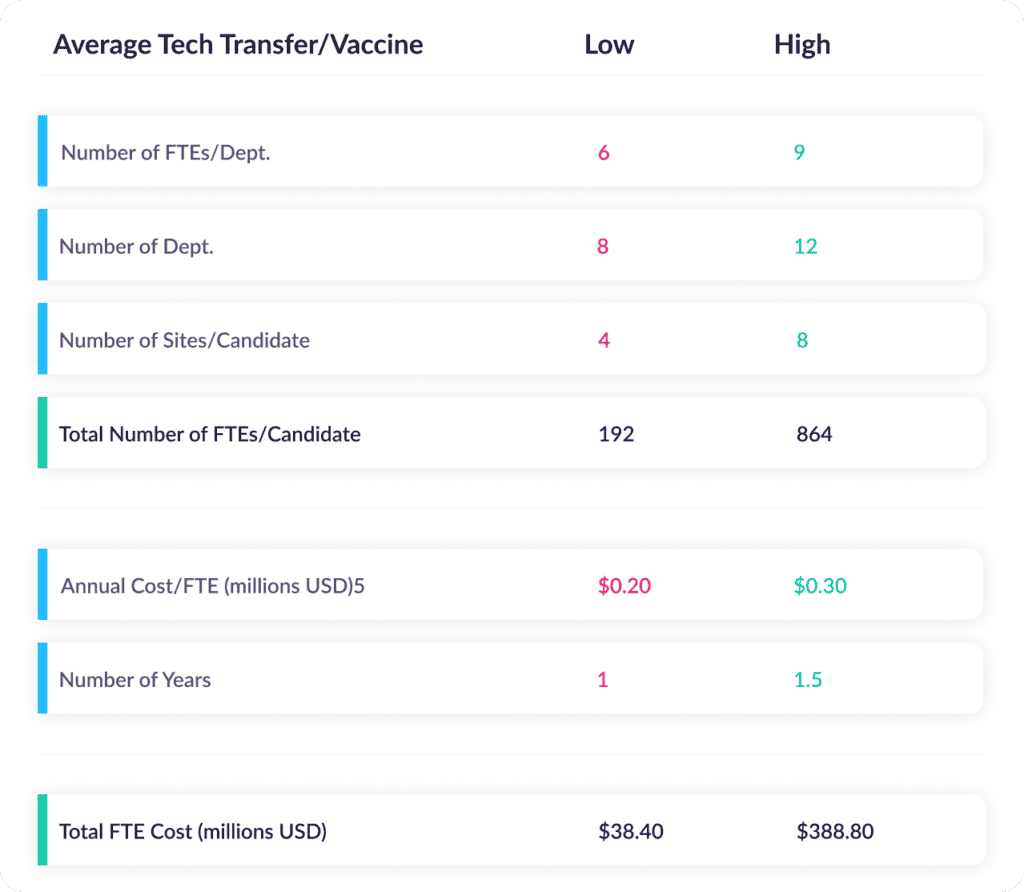

So what kind of costs does all that time add up to? The McKinsey report goes on to cite the resources required for a typical tech transfer for a vaccine candidate. Here are their assumptions and associated costs for the sourcing, planning, and technical transfer phases:

You read that right: For a 28-month tech transfer, the cost can range from $38M to $389M in personnel costs alone. That’s more than a gate on a critical path. That’s a boulder on the pathway to launch.

The good news: There’s already a modern approach to tech transfer that can help break that rock down to granular, interlinked, easily shareable pieces. The tricky news: Breaking the boulder of legacy methods will take some work.

How much work? Let’s look a little closer at what’s really driving those time/cost pain points.

Hint: It’s not calibrating the bioreactors.

“Okay, who’s got my binder?”

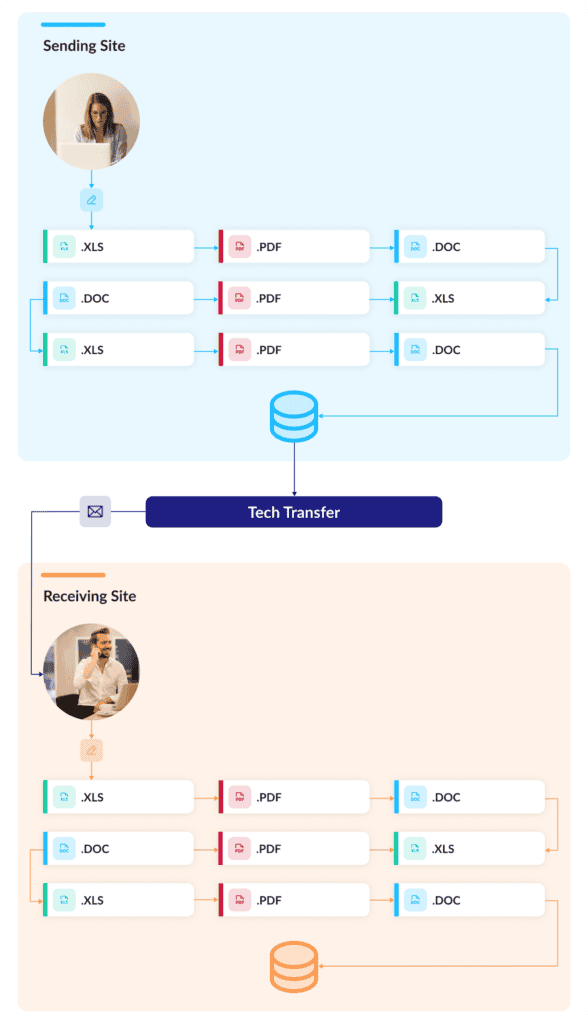

As any experienced CMC contributor can tell you, McKinsey’s report is “yikes” accurate: Each phase can involve large numbers of specialized personnel, complex workflows, multi-layered exchanges, and both physical and virtual workflows. But above all, every step in the process involves documents: hundreds, and hundreds, and hundreds of documents.

Reports, data tables, specifications, risk analyses: they come thick and fast in any tech transfer, usually over email and with little concern for workflow, collaboration, change management, or future use of the information they contain. Electronic or paper, and regardless of format—PDF, Word, Excel, PPT—all these documents bury a wealth of data and information in unstructured narratives. And while cloud-based collaboration tools like SharePoint have incrementally improved how these documents are exchanged and stored, it’s usually at the cost of complex folder structures that are onerous to navigate.

No matter how or where they’re stored, though, these documents have to be meticulously combed to extract the key technical information they contain. Making matters worse, all this information then gets duplicated in a new set of tech transfer documents describing gap and risk assessments, risk mitigation activities, and various plans. Documents beget documents that beget more documents.

With every new layer of documentation, the knowledge and information in those files get buried deeper and deeper—frozen in static formats that rarely reflect inevitable site-level adaptations. It’s a tedious, time-consuming, and archaic way to handle vast volumes of technical data. But it remains the industry’s default standard.

Today, of course, the limitations of this approach are all too well known. But all too often, the proposed solution is writing better documents or implementing better templates—marginal “improvements” that leave the problem intact. To truly solve these challenges, CMC programs need a transformational new way to manage their data and knowledge.

And guess what: It’s already here.

Digital CMC: The secret to accelerating tech transfers

Simply put, Digital CMC is a way of reimagining how we manage drug development data. It’s a modern, granular method of tracking that data in structured repositories where individual information nodes can be connected to create a multidimensional dataset that’s easily searched and analyzed.

These structured repositories are based on vertical integration of a knowledge base. In a Digital CMC framework, requirements are fully integrated with risk assessment tools, tangible production assets, and manufacturing data and analytics, bringing together every dimension of the data needed to define and justify the specific control strategies for a manufacturing process.

And that’s where the magic begins.

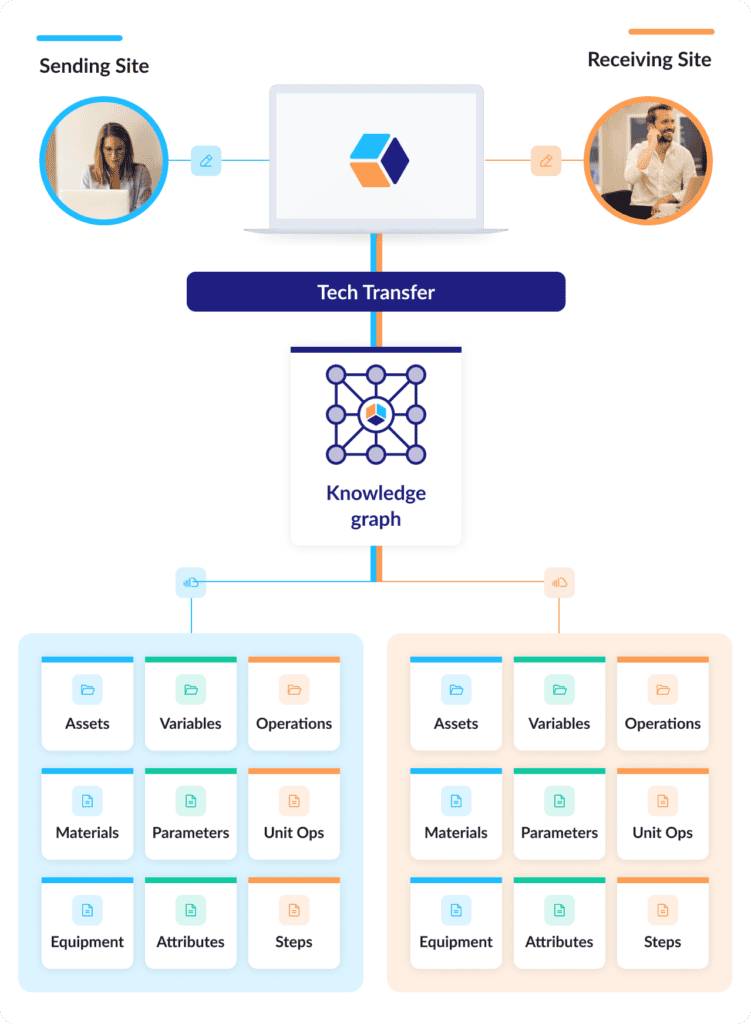

With digitized CMC information, transfers can be effectively instantaneous: sending sites can simply share their digitally represented manufacturing process with their receiving sites. Gap and risk assessments can be dramatically streamlined too: With digital datasets on both ends of the transfer, sending and receiving site processes can be easily compared element by element to identify discrepancies, flag necessary changes, and assess risks.

And those are far from the only benefits. Digital tech transfer ensures information is standardized and consistent—vital under any circumstances, but especially important for international or company-to-company transfers. Plus, transfers based on structured data frameworks lay the groundwork for digital best practices in many downstream processes: commercial manufacturing, continuous process verification, postapproval change management, and more.

This approach can slash both the time and costs associated with tech transfer projects. Conservative projections show potential cost savings that range from 77% to 83%, based on just time and personnel savings alone. Meanwhile, real-world experience has shown that major drug developers can reduce their tech transfer costs by as much as 50% per transfer by adopting Digital CMC methodologies.

And it all starts with just one critical step.

Why structuring CMC data is the key

Ultimately, traditional data management methods and the Digital CMC approach are two different ways to accomplish similar goals: capturing, organizing, and curating program data. The big difference: only one of these approaches makes that data easily accessible, searchable, visualizable, and more.

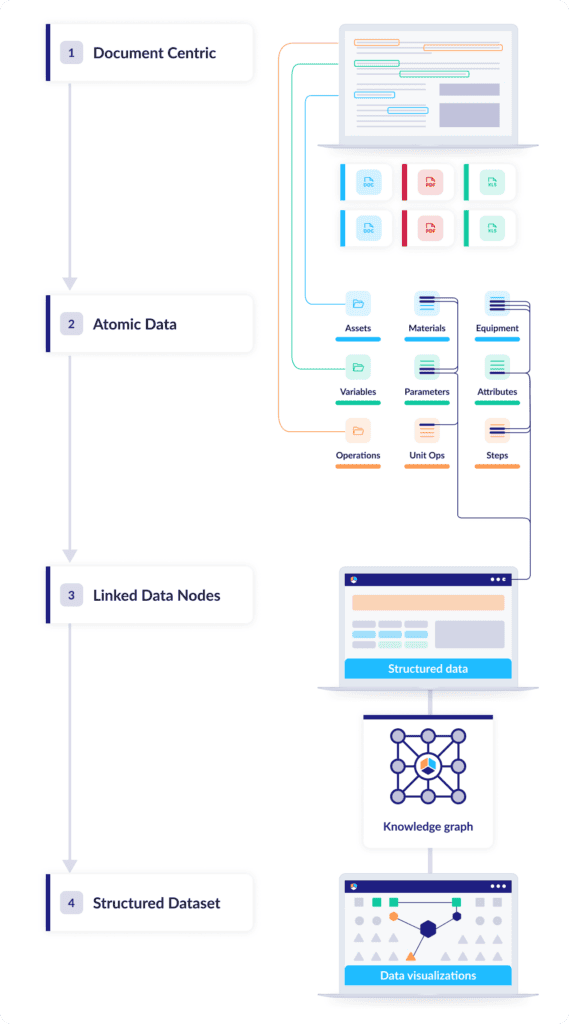

The defining trait of document-based data is flatness: The information has no depth greater than the document it’s stored in, and it’s all compressed into a single narrative layer with no connection to any other data source. Digital CMC adds dimension, and for dimension you need structure: discrete nodes of information that can be linked, connected, and organized into datasets, like atoms in a molecule.

Structuring CMC data this way unlocks a range of powerful functions: just to name a few, nodes of interest can be easily searched and identified, chains of causality become easy to trace, and the overall structure can be easily aligned with commercial phases. Once that dataset contains all the information related to your manufacturing processes and control strategy, you can query, analyze, and contextualize any component of that data in just a few clicks.

The next step: Vertically integrating the data structure

Converting unstructured data into individual connected data nodes—or “atomizing” the data—is a big step toward tackling tech transfers’ biggest challenges. But it’s by no means the whole solution. Structures are meant to be built on, and that’s a key goal of Digital CMC methodologies: transforming connected data into a vertically integrated knowledge base with a product-centric model optimized for commercialization and post-approval operations.

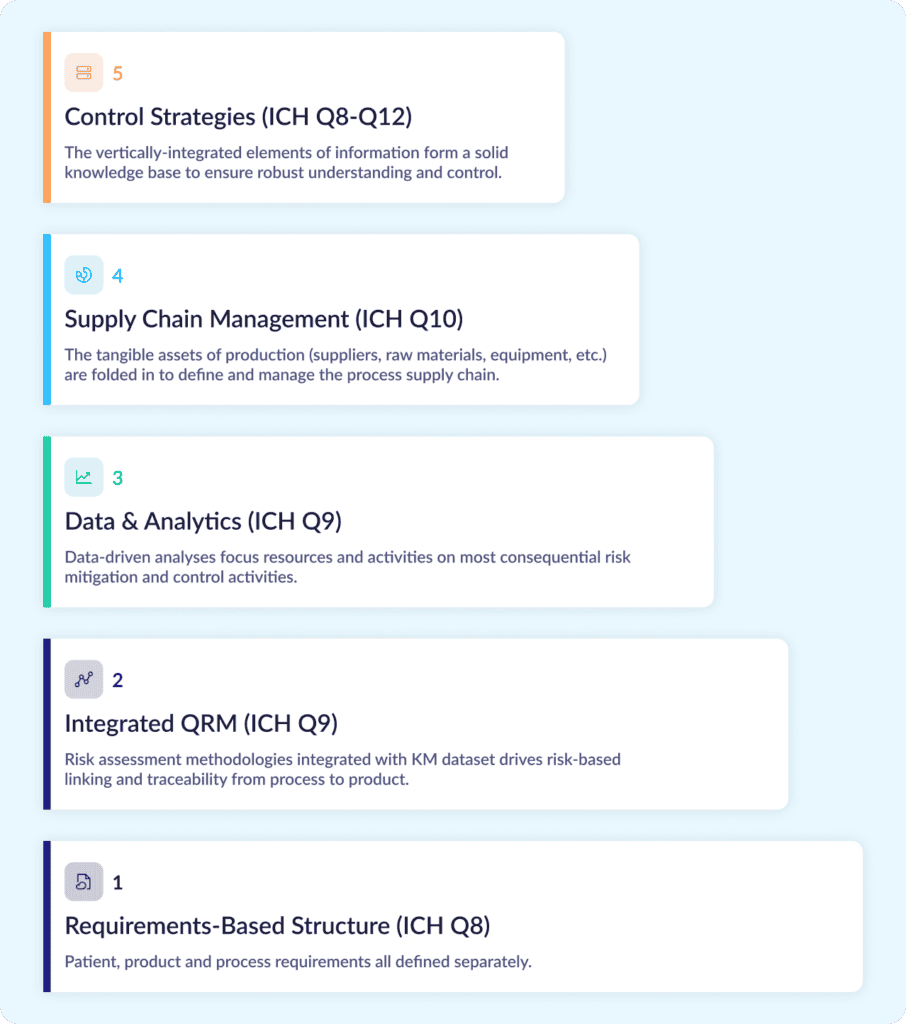

How should that framework be organized? For drug developers, the International Conference on Harmonization (ICH) has provided an architecture globally endorsed by regulatory agencies and the industry. The figure below shows a vertically integrated information structure specific to drug development, where requirements form the foundation of the Digital CMC knowledge base and context builds over time to provide a complete story of control with appropriate justification. This structure also aligns nicely with the requirements of pharmaceutical development outlined in ICH guidelines Q8 to Q12.

Here’s a step-by-step look at how it takes shape:

- Stage 1 of this framework starts with a requirements-based foundation where patient, product, and process requirements can all be defined and tracked individually with their associated information.

- Stage 2 adds the tools of quality risk management (QRM) described in ICH Q9 and Q10. Each requirement can then be separately assessed for risk, while process requirements can be digitally linked to product requirements and product requirements can be linked back to patient safety/efficacy attributes. This creates risk-based traceability as recommended throughout ICH Q8–Q10.

- Stage 3 integrates raw material and manufacturing data. This data can be analyzed to identify trends and assess process capabilities, enabling a key feedback loop that ensures consistent focus on areas that need the greatest attention.

- Stage 4 folds in the tangible assets of production: raw materials, components, and equipment. While traditional data management methods provide limited visibility into these factors, digitally tracking how these assets influence qualification, performance, and supplier risk helps enable the 360-degree view recommended by ICH Q10.

- Stage 5 uses all the other stages to justify the control strategies identified for the validated process. With the strong knowledge base established in steps 1-4, it’s much easier to define those strategies, defend them over time, and manage inevitable process changes and impact assessments post-approval.

In those 5 steps, CMC data takes a complete journey from flat, document-bound narratives to a comprehensive, structured, contextualized CMC dataset. Within that structure, each and every data element is easily accessible. Process relationships, interdependencies, and chains of causality jump off the screen. True process understanding takes shape.

Powerful enough already? Let’s take a look at how this concept can turn one of drug development’s biggest roadblocks into a seamlessly efficient digital workflow.

How Digital CMC lays the foundation for digital tech transfer

If you’re wondering whether structuring CMC data is a must-do step or a nice-to-have bonus, consider how long it typically takes to develop a new drug product using traditional approaches to process development, manufacturing, and validation: as long as 7-8 years.

During this period, vast amounts of data are generated by complex activities essential to product formulation, manufacturing process, recipes, materials, equipment, and more—and that’s all within one originating site. All that knowledge and information will eventually need to be transferred to a different site or sites, whether to scale up production, expand existing capacity, or in-house a manufacturing program.

Can that be accomplished using conventional document-based methods? Absolutely. But doing so can often make that 7-8-year figure a conservative one. Document-based tech transfer can get bogged down at multiple steps, with a seemingly endless loop of document production that only gets worse at the regulatory finish line—and then gets multiplied by every site that needs to onboard the product and its processes.

So how would that scenario change if the relevant CMC data were represented in a structured data framework using a Digital CMC approach? In that case, a transfer that might otherwise take numerous meetings and hundreds of documents to initiate can start much, much faster—with the click of a button.

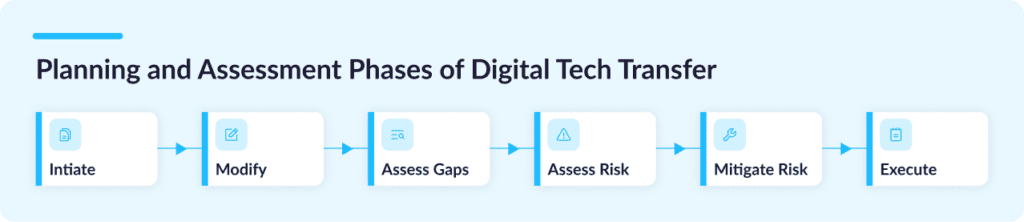

With a digital tech transfer, an entire multi-year process can typically be distilled into 6 core steps:

Step 1: Initiate

To start a digital tech transfer, all a sending site needs to do is clone their process description into a new process structure for the receiving site in the Digital CMC platform. Cntrl-C, Cntrl V, done: unit operations, steps, materials, equipment, process parameters, material attributes, in-process controls, everything.

Bonus: A Digital CMC platform with a structured data framework can automatically link sending-site data and receiving-site data. Both datasets can then be instantly compared at any point in the transfer process, no digging through documents and reports required.

Step 2: Modify

Post-clone, the receiving site can then adapt individual aspects of the process to optimize them for a new scale or facility. Using a bigger bioreactor from a different supplier? The structured data framework makes it easy to find and modify those parameters..

Step 3: Gap Assessment

Once the receiving site has adapted the process, sender and receiver then have two iterations of the original dataset that can be compared node by node. A couple of clicks can display side-by-side views that illuminate gaps and divergences and enable both sides to drill down further anywhere they need to.

Step 4: Risk Assessment

Once sites have identified the gaps and differences between their process iterations, they need to answer another big question: Which ones really matter? With node-level visibility into their gap assessment, answering that question is simple: A Digital CMC platform with integrated risk assessment capabilities can make it easy to separately assess the relative risk each node pair may pose to the overall transfer.

Step 5: Risk Mitigation

Once they’ve identified all their risks, sites can take data-guided steps to evaluate how the receiving site process performs relative to the sending site’s source version. Multiple workflows—characterization studies, supply chain management, quality management, and more—may all need to be conducted to confirm that the iterated process meets the required specifications and to provide justifications for any transfer-related regulatory approvals or notifications.

Step 6: Execute

Lastly, both sending and receiving sites can finalize the transfer by evaluating operational readiness, qualifying the process performance at the new site, and completing a final review.

The ultimate outcome of these 6 steps: A complete set of process data for each pair of sending and receiving sites.

The endless document routing stops: Since the data elements on both sides have been freed from static formats, the data in the Digital CMC platform are always current. Tech transfer reports that might have taken months to create and review can now be collaboratively updated in real time and published at the click of a button.

So what’s that worth in the numbers that really matter? Let’s take a look!

The ROI of digital tech transfer

First, let’s flash back to that McKinsey estimate: $38M to $389M in personnel costs for a 28-month tech transfer. And that doesn’t factor in delays due to poor planning or understanding of the process or analytical methods—or, for that matter, additional material/CAPEX costs due to manufacturing deviations or qualification failures at the receiving site.

But what if a drug developer managed their tech transfer with a Digital CMC platform like QbDVIsion? What if they took a structured digital approach that eliminated burdensome documents and enabled instant process sharing and point-to-point risk analyses across every site in the transfer?

It’s not hard to imagine the dramatic savings they could unlock. But actually, we don’t have to. Here’s just a taste of the kind of remarkable savings some QbDVIsion users have achieved:

Global enterprise drug developer

75%

reduction in internal tech transfer costs

80%

reduction in labor costs for average site-to-site tech transfer

50%

reduction in time to perform gap assessments

Major regional generics manufacturer

95%

reduction in reporting times

3X

faster internal tech transfers

50%

reduction in time to perform gap assessments

Mid-sized US drug developer

6-12 months

eliminated from tech transfer timelines

3X

faster internal tech transfers

That’s the power of deploying a Digital CMC solution. It doesn’t just digitize data exchange: It streamlines the entire tech transfer workflow, from eliminating meetings to reducing manual tasks, simplifying risk assessments, and automating regulatory documentation. The savings for drug developers can be dramatic: in fact, a conservative projection of program savings indicates that per-transfer savings could be up to $6.6M… for every single transfer projects.

The question, then, isn’t whether drug developers should adopt a Digital CMC approach to accelerating tech transfers. McKinsey’s report—and the real-world savings that approach is already delivering—make it clear that digitizing this essential process is now unequivocally a must.

Ready to get started? We absolutely are!

As you can see, a Digital CMC platform like QbDVision can open up a world of possibilities for dramatic efficiency improvements. If you’d like to see how your organization could reap some of those benefits with your next “tech sharing” workflow, reach out to our experts at any time. We’ll be more than happy to show you how QbDVIsion can streamline and accelerate this vital process.